From the Structure sub-menu on the left, select Accounting Activity.

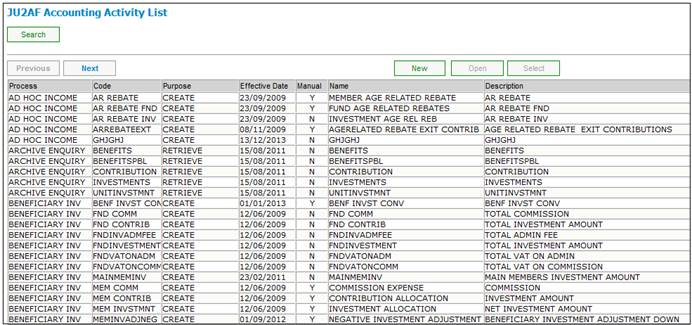

The JU2AF Accounting Activity List screen will be displayed.

Purpose:

Read and display all the records of Accounting Activity (Display Attributes: Process, Code, Purpose, Effective Date, Manually Initiated Indicator, Description). Sorted by Process and/or Purpose.

Definition:

An Accounting Activity represents a step in a process which needs to create an accounting entry (or entries), or which needs to retrieve information from accounting entries.

Navigation:

This screen is called from the Accounting>Structure menu to maintain the Accounting Activities.

Screen Pushbutton Functions

|

New |

Flows to JU2AF Accounting Activity Details screen to add a record to the list and refresh list on return |

|

Open |

Opens the JU2AF Accounting Activity Details screen with the selected information. Allows the updating of Description, Income Type Required for Rule, EFT Rules Required, Manually Initiated Indicator and Discontinue Date only. Refreshes list on return. |

|

Select |

Passes the record selected on the list back to the calling procedure. |

|

Close |

Closes screen and returns to Main Menu. |

|

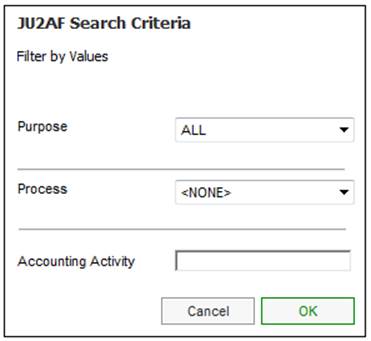

Search |

Opens the criteria box to allow the search criteria to be entered. Opens dialog box JU2AF Search Criteria to filter the list on the current screen for selected values of PURPOSE and PROCESS and a specified Accounting Activity.. |

|

Previous |

Displays previous list screen. Enabled if rows exist prior to the current screen. |

|

Next |

Displays next list screen. Enabled if rows exist after the current screen. |

|

Accounting Rules |

Flows to the JU2AG Accounting Rule List screen (to maintain Accounting Rules). Enabled when an Accounting Activity with Purpose of "create" is selected in the list. |

|

Retrieval Rules |

Flows to the JU2AL Retrieval Rule List screen (to maintain Retrieval Rules). Enabled when an Accounting Activity with Purpose of "retrieval" is selected in the list. |

|

EFT Rules |

Flows to the JU2AI EFT Rule List screen (to maintain EFT Rules). Enabled when an Accounting Activity with eft_indicator ="Y" is selected in the list. |

|

Note |

Flows to the JVOAA Maintain Notation screen. Enabled when an Accounting Activity with Purpose of "create" or "retrieve" is selected in the list. |

Notes:

- These Menu actions are available to authorized users only

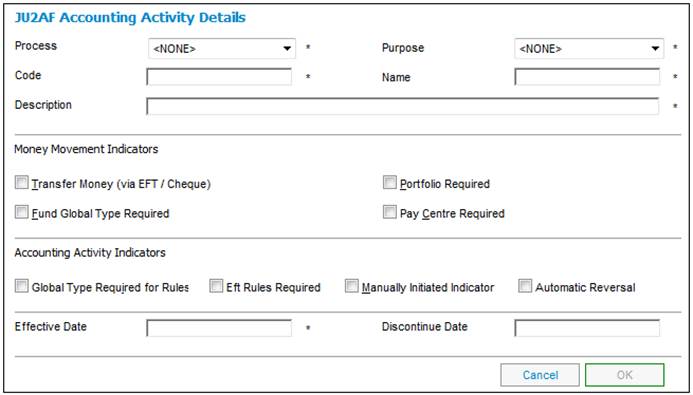

Purpose:

To facilitate the creation, update or display of an Accounting Activity record. This screen displays the existing values of all attributes for the Accounting Activity created or selected from the list.

Navigation:

Called from the JU2AF Accounting Activity List screen.

Screen Field Definitions

|

Process |

The Process for which the Accounting Activity is created. Displayed value obtained from the Permitted Value Lookup Table in the database, e.g. "Benefit Payment" Mandatory, Number: Length: 11 Decimal places: 0. Default: <None> |

||

|

Purpose |

Defines the Purpose for which an Accounting Activity is being used. Mandatory, Text Length: 15 Default: Create Permitted Values: Create, Retrieve. |

||

|

Code |

The Code together with the Process uniquely identifies an Accounting Activity. Possible Value: Allocate PAYE Tax: Mandatory, Text Length: 15. Default: <None> |

||

|

Name |

Used in addition to Code to identify the source of the transaction on accounting transactions enquiries. Note: This will be the print display name on the Member Website. |

||

|

Description |

A description of the Process and Code. Mandatory, Text Length: 70 Default: <Not applicable> |

||

|

Money Movement Indicators |

|

||

|

Transfer Money (via EFT /Cheque) |

Indicates whether the activity will result in a Money Movement Instruction. Depending on the payment type, either a cheque or an EFT will be generated when an occurrence of this activity takes place. Mandatory, Text Length: 1 Default: N Permitted Values: Y , N |

||

|

Portfolio Required |

Indicates whether or not a separate EFT rule must exist for each portfolio. When ticked, it implies that a portfolio value must be supplied when using the activity, as the process will need to determine which specific EFT rule to use. |

||

|

Fund Income Type Required |

Indicates whether or not a separate EFT rule must exist for each scheme income type. When ticked, it implies that a scheme income type value must be supplied when using the activity, as the process will need to determine which specific EFT rule to use. |

||

|

Pay Centre Required |

Indicates whether or not a separate EFT rule must exist for each pay centre. When ticked, it implies that a pay centre value must be supplied when using the activity, as the process will need to determine which specific EFT rule to use. |

||

|

Accounting Activity Indicators |

|

||

|

Global Type Required for Rules |

Indicates whether or not a separate accounting rule must exist for each global type. When ticked, it implies that a global type value must be supplied when using the activity, as the process will need to determine which specific accounting rule to use. |

||

|

EFT Rules required |

Indicates whether or not EFT (Bank Account) rules must be set up for this Accounting Activity. This will be required if any of the account codes to be debited or credited is a bank account (qualified by DTI Account). Note: If this indicator is ticked, but the EFT rules for a specific scheme and activity has been omitted, the user will be able to supply both bank account numbers at the time of the transaction.

If the Transfer Money (via EFT /Cheque) field has been ticked, this field will automatically be ticked by the system. |

||

|

Manually Initiated Indicator |

Indicates whether or not the Accounting Activity can be initiated manually, using the manual transaction accounting option. Optional, Text Length: 1 Default= N Permitted Values: Y, N Note: The MANUALLY INITIATED INDICATOR checked box will automatically be set to ticked if the process is MANUAL INITIATE. If the process is not MANUAL INITIATE, it will be set to N and update will not be enabled. |

||

|

Automatic Reversal |

Indicates whether or not the automatic reversal of journals must be applied for this accounting activity. Note: This means that where provisions are posted as at a month-end or year-end, these journals must be reversed in the following month automatically.

The accounting activity for the reversal to the original transaction will be associated to the originating accounting activity. |

||

|

Effective Date |

The date when the ACCOUNTING ACTIVITY becomes effective. Mandatory: Basic Date, Length: 8, Default = <spaces> |

||

|

Discontinue Date |

The date of when the ACCOUNTING ACTIVITY is no longer in use. Optional: Basic Date, Length: 8, , Default = <spaces> |

||

Notes

Screen Fields

- Only the "Description", "Discontinue Date" and "Manually Initiated Indicator" fields are enabled when this screen is opened for an existing Accounting Activity.

- When the "Transfer Money (via EFT / Cheque)" indicator for an Accounting Activity is set to "Y", one of the Accounting Rules attached must contain a BT that Updates an account that is qualified by DTI (Bank Account Number).

- This activity is performed by an authorized "super user".

- Once an instance of Accounting Activity has been created, it may not be deleted (there is no delete facility) but may only be discontinued. Discontinuance prevents future allocation for use of the instance while preserving existing usage.

- The above Menu actions are available to authorized users only

Push Buttons:

- The OK button is enabled only once the mandatory fields are populated.

- Cancel will ignore all values entered and return to the previous screen.

Validation Checks:

- Effective Date cannot be less than current date (may be future dated).

- Discontinue Date cannot be less than current date (may be future dated).

- Discontinue Date cannot be less than Effective date.

- If Discontinue Date has a value greater than current date, then the Discontinue Date may be changed. If Discontinue Date has a value less than or equal to current date, then it may not be changed.