This report provides an extract of active member, deferred member and pensioner data across all schemes as at a specified date.

The following information is extracted depending on the scheme:

1964 Pension Scheme

Post ISIS, there are no active members in the 1964 scheme and therefore Total number of active members refers to active members in Afterwork or PIP that have a deferred membership in the 1964 scheme.

Total pensionable salary (full time equivalent and actual) refers to the total pensionable salary of active members in Afterwork or PIP that have a deferred membership in the 1964 scheme.

- Total number of active members

- Total pensionable salary (full time equivalent and actual)

- Total number of deferred pensioners (GMP only members shown separately)

- Total current deferred pensions (GMP only members shown separately)

- Total number of pensioners

- Total pensions

- Total number of spouses’ and children’s pensions

- Total spouses’ and children’s pensions

Afterwork and RIS

Post ISIS, the Total Credit Account balance for active members and the Total Credit Account balance for deferred members must be split between the active Afterwork or RIS non-legacy members and the active Afterwork members that have a deferred membership in the 1964, Career Average, Capel Cure Sharp, 1951, Mercantile, Allied Provincial, Friends Provident or Woolwich Geurnsey schemes, split by previous scheme.

- Total number of active members per member contribution rate

- Total pensionable salary per member contribution rate

- Total Credit Account balance for active members

- Total number of deferred pensioners

- Total Credit Account balance for deferred members

- Total number of pensioners

- Total pensions

- Total number of spouses’ and children’s pensions

- Total spouses’ and children’s pensions

PIP

- Total number of active members

- Total pensionable salary

Career Average

Post ISIS, Total number of active members refers to active members in Afterwork or PIP that have a deferred membership in the Career Average scheme.

Total pensionable salary (full time equivalent and actual), refers to total pensionable salary of active members in Afterwork or PIP that have a deferred membership in the Career Average scheme.

- Total number of active members

- Total pensionable salary

- Total number of deferred members

- Total number of pensioners

- Total pensions

Former members of 1951 Fund, Mercantile, Allied Provincial, Barclays Capital and Capel Cure

Post ISIS, Total number of active members per section refers to active members in Afterwork or PIP that were previously members of the 1951 Fund, Mercantile, Allied Provincial, Barclays Capital and Capel Cure schemes.

Total pensionable salary per section refers to total pensionable salary of active members in Afterwork or PIP that were previously members of the 1951 Fund, Mercantile, Allied Provincial, Barclays Capital and Capel Cure schemes.

- Total number of active members per section

- Total pensionable salary per section

From the General menu under Scheme Reports, click ![]() alongside IAS19 Report on the sub-menu on the left. Additional options will be displayed.

alongside IAS19 Report on the sub-menu on the left. Additional options will be displayed.

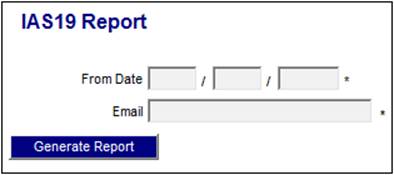

Click New below IAS19 Report. The IAS19 Report screen will be displayed.

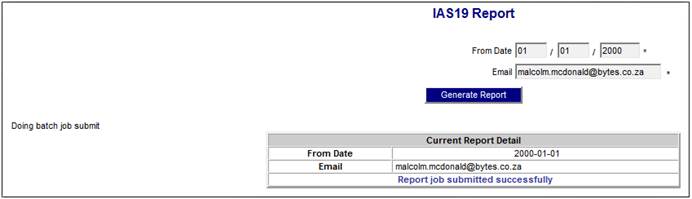

Capture the date from which the report must apply in the From Date field and supply your email address.

Click GENERATE REPORT.

The screen will display the captured details for the report with the message:

Doing batch job submit

The system will extract the required information as per the details below:

- If the Scheme selected has a Pooling Status of MAIN UMBRELLA, the system will extract the information for all of the Schemes with a Pooling Status of SUB UMBRELLA linked to the Main Scheme selected.

- In all cases, if no records are found, the system will display the value in the report as zero.

The system will create a report for each of the following sections with the Type of Report indicated:

|

Section |

Type of Report |

|

Actives |

IAS19_ACTIVES |

|

Pensioners (Includes Widows / Children) |

IAS19_PENSIONERS |

|

Credit Account |

IAS19_CREDIT_ACCOUNT |

|

Deferreds |

IAS19_DEFERREDS |

|

|

Information |

Vision Source |

|

|

ACTIVES |

|

|

1 |

Number of active members |

Find all of the Membership records for which the Status as at the Effective Date of the report is LIVE or PHI and sum the Memberships as follows: 1. For each Member check if there is a Member Values record with a Type of CONVERSION. If found read the value for Sub Type and store this as the Member’s Scheme prior to conversion. Sum the Members with same previous Scheme per Scheme. 2. For the Members for which a CONVERSION record is not found read the Members’ Benefit Membership Group and find the Members with an Opted Out Life Assurance Only Membership Group i.e. one of the following membership Groups;BA11, BA12, BA13, BA14, BA15, BA16, BA17 or BA18. (see 2.2.1.1 Opt Out Life Assurance Only Membership Groups below) Sum the Members with the same Membership Group per Scheme. 3. For the Members for which a CONVERSION record is not found and for which the Benefit Membership Group is not BA07, BA11, BA12, BA13, BA14, BA15, BA16, BA17, BA18, BA19 or BA20.read the Members’ Contribution Membership Group and find the Members for which the Contribution Membership Group is C07 (Afterwork Reduced). Sum the Members per Scheme. 4. For the Members for which a CONVERSION record is not found and for which the Benefit Membership Group is not BA07, BA11, BA12, BA13, BA14, BA15, BA16, BA17.BA18, BA19 or BA20 read the Members’ Contribution Membership Group and find the Members for which the Contribution Membership Group is not C07 (Afterwork Reduced). Sum the Members per Scheme. 5. For the Members for which a CONVERSION record is not found and for which the Benefit Membership Group is BA07 or BA19. 6. For the Members for which a CONVERSION record is not found and for which the Benefit Membership Group is BA20. |

|

2 |

Number of active members previous period |

Find all of the Membership records for which the Status as at the Effective Date of the report minus 6 months is LIVE or PHI and sum the Memberships as follows: 1. For each Member check if there is a Member Values record with a Type of CONVERSION. If found read the value for Sub Type and store this as the Member’s Scheme prior to conversion. Sum the Member with same previous Scheme per Scheme. 2. For the Members for which a CONVERSION record is not found read the Members’ Benefit Membership Group and find the Members with an Opted Out Life Assurance Only Membership Group i.e. one of the following membership Groups;BA11, BA12, BA13, BA14, BA15, BA16, BA17 or BA18. Sum the Members with the same Membership Group per Scheme. 3. For the Members for which a CONVERSION record is not found and for which the Benefit Membership Group is not BA07, BA11, BA12, BA13, BA14, BA15, BA16, BA17, BA18 BA19 or BA20.read the Members’ Contribution Membership Group and find the Members for which the Contribution Membership Group is C07 (Afterwork Reduced). Sum the Members per Scheme. 4. For the Members for which a CONVERSION record is not found and for which the Benefit Membership Group is not BA07, BA11, BA12, BA13, BA14, BA15, BA16, BA17, BA18 BA19 or BA20 read the Members’ Contribution Membership Group and find the Members for which the Contribution Membership Group is not C07 (Afterwork Reduced). Sum the Members per Scheme. 5. For the Members for which a CONVERSION record is not found and for which the Benefit Membership Group is BA07 or BA19. 6. For the Members for which a CONVERSION record is not found and for which the Benefit Membership Group is BA20. If no records are found display the value in the report as zero |

|

3 |

Variance |

Calculate the percentage difference between the value in 1 and 2 above per group and per previous Scheme where applicable. Calculate to 2 decimal places with normal rounding i.e. 0-4 round down and 5-9 round up. If the value for the previous period is zero display the value as zero. |

|

4 |

Total Full Time Equivalent Salary

|

For each of the Memberships for which the Status is LIVE or PHI as at the Effective Date of the report read the Actual Earning records effective as at the Effective Date of the report. If the Membership Status is PHI find the Actual Earnings with a Type of FTEN. If the Membership Status is LIVE find the Actual Earnings with a Type of NSS. If no record is found or the value for the NSS Actual Earning record as at the Effective Date of the report is zero, find the Actual Earning with a Type of FTEU and sum the values as per the groups 1, 2, 3, 4, 5 and 6 in 1 above. |

|

5 |

Total Full Time Equivalent Salary previous period

|

For each of the Memberships for which the Status is LIVE or PHI as at the Effective Date of the report minus 6 months read the Actual Earning records effective as at the Effective Date of the report minus 6 months. If the Membership Status is PHI find the Actual Earnings with a Type of FTEN. If the Membership Status is LIVE find the Actual Earnings with a Type of NSS. If no record is found or the value for the NSS Actual Earning record as at the Effective Date of the report minus 6 months is zero, find the Actual Earnings with a Type of FTEU and sum the values as per the groups 1, 2, 3, 4, 5 and 6 in 2 above. If no records are found display the value in the report as zero |

|

6 |

Variance |

Calculate the percentage difference between the values in 4 and 5 above per group and per previous Scheme where applicable. Calculate to 2 decimal places with normal rounding i.e. 0-4 round down and 5-9 round up. If the value for the previous period is zero display the value as zero. |

|

7 |

Total Actual Salary |

For each of the Memberships for which the Status is LIVE or PHI as at the Effective Date of the report read the Actual Earning records with a Type of FULL TIME HOURS and PART TIME HOURS effective as at the Effective Date of the report. Calculate the Total Actual Salary per Member as follows and sum the results per groups 1, 2, 3, 4, 5 and 6 in 1 above: Total Full Time Equivalent Salary divided by Full Time Hours multiplied by Part Time Hours |

|

8 |

Total Actual Salary previous period |

For each of the Memberships for which the Status is LIVE or PHI as at the Effective Date of the report minus 6 months read the Actual Earning records with a Type of FULL TIME HOURS and PART TIME HOURS effective as at the Effective Date of the report minus 6 months. Calculate the Total Actual Salary per Member and sum the results per groups 1, 2, 3, 4, 5 and 6 in 1 above. If no records are found display the value in the report as zero |

|

9 |

Variance |

Calculate the percentage difference between the values in 7 and 8 above per group and per previous Scheme where applicable. Calculate to 2 decimal places with normal rounding i.e. 0-4 round down and 5-9 round up. If the value for the previous period is zero display the value as zero. |

|

|

CREDIT ACCOUNTS |

|

|

10 |

Membership Totals |

Count the Memberships for which a value is calculated in 13 below per 1. Previous Scheme, 2. Category and 3.Scheme. |

|

11 |

Membership Totals previous period |

Count the Memberships for which a value is calculated in 14 below per 1. Previous Scheme, 2. Category and 3.Scheme. If no records are found display the value in the report as zero |

|

12 |

Variance |

Calculate the percentage difference between the values in 10 and 11 above per previous 1. Scheme, 2. Category and 3. Scheme. Calculate to 2 decimal places with normal rounding i.e. 0-4 round down and 5-9 round up. If the value for the previous period is zero display the value as zero. |

|

13 |

Total Credit Account balances for active members |

Determine the market value of the LIVE and PHI Members’ Credit Account investments. Retrieve the Monetary balance on the Member’s INVESTMEMB accounts and the unit balance on the Member’s INVSTMEMUNIT accounts for the Income Types for which the value for Member Investment Choice is N as at the Effective Date of the report. If the Type of Investment is UNITISED find the unit price applicable as at the Effective Date of the report depending on the Pricing Method and calculate the market value. If the Type of Investment is BONUS find the interest rate applicable as at the Effective Date of the report and calculate interest from the date of the last interest allocation to the Effective Date of the report. Sum the Market Values as follows: 1. For each Member check if there is a Member Values record with a Type of CONVERSION. If found read the Members’ Benefit Membership Group and find the Members with an Opted Out Life Assurance Only Membership Group i.e. one of the following membership Groups;BA11, BA12, BA13, BA14, BA15, BA16, BA17 or BA18. Read the value for Sub Type on the Member Values record and store this as the Member’s Scheme prior to conversion. Sum the market values of the unitised portfolios, the monetary balances on the bonus portfolios and the interest calculated for the bonus portfolios for all of the Members with same previous Scheme. 2. For each Member check if there is a Member Values record with a Type of CONVERSION. If found read the Members’ Benefit Membership Group and find the Members for which the Benefit Membership Group is not an Opted Out Life Assurance Only Membership Group i.e. one of the following membership Groups;BA11, BA12, BA13, BA14, BA15, BA16, BA17 or BA18. Read the value for Sub Type on the Member Values record and store this as the Member’s Scheme prior to conversion. Sum the market values of the unitised portfolios, the monetary balances on the bonus portfolios and the interest calculated for the bonus portfolios for all of the Members with same previous Scheme. 3. For the Members for which a CONVERSION record is not found read the Members’ Benefit Membership Group and find the Members with an Opted Out Life Assurance Only Membership Group i.e. one of the following membership Groups;BA11, BA12, BA13, BA14, BA15, BA16, BA17 or BA18. Sum the market values of the unitised portfolios, the monetary balances on the bonus portfolios and the interest calculated for the bonus portfolios for all of the Members with the same Membership Group 4. Sum the market values of the unitised portfolios, the monetary balances on the bonus portfolios and the interest calculated for the bonus portfolios for all of the Members for which a CONVERSION record or an Opt Out Life Assurance Only Membership Group is not found. |

|

14 |

Total Credit Account balances for active members previous period |

Determine the market value of the LIVE and PHI Members’ Credit Account investments. Retrieve the Monetary balance on the Member’s INVESTMEMB accounts and the unit balance on the Member’s INVSTMEMUNIT accounts for the Income Types for which the value for Member Investment Choice is N as at the Effective Date of the report minus 6 months. If the Type of Investment is UNITISED find the unit price applicable as at the Effective Date of the report minus 6 months depending on the Pricing Method and calculate the market value. If the Type of Investment is BONUS find the interest rate applicable as at the Effective Date of the report minus 6 months and calculate interest from the date of the last interest allocation to the Effective Date of the report. Sum the market values of the unitised portfolios, the monetary balances on the bonus portfolios and the interest calculated for the bonus portfolios for all of the Members per category as per 13 above. If no balances are found display the value in the report as zero. |

|

15 |

Variance |

Calculate the percentage difference between the Total Credit Account balances calculated in 13 and 14 above per previous Scheme, Opt Out Life Assurance Only Membership Group and other Members. Calculate to 2 decimal places with normal rounding i.e. 0-4 round down and 5-9 round up. If the value for the previous is zero display the value in the report as zero. |

|

16 |

Membership Totals |

Count the Memberships for which a value is calculated in 19 below. |

|

17 |

Membership Totals previous period |

Count the Memberships for which a value is calculated in 20 below If no records are found display the value in the report as zero |

|

18 |

Variance |

Calculate the percentage difference between the values in 16 and 17 above. Calculate to 2 decimal places with normal rounding i.e. 0-4 round down and 5-9 round up. If the value for the previous period is zero display the value as zero. |

|

19 |

Total Credit Account balances for deferred members |

Determine the market value of the DEFERRED and DEF ANNUITANT Members’ Credit Account investments. Retrieve the Monetary balance on the Member’s INVESTMEMB accounts and the unit balance on the Member’s INVSTMEMUNIT accounts for the Income Types for which the value for Member Investment Choice is N as at the Effective Date of the report. If the Type of Investment is UNITISED find the unit price applicable as at the Effective Date of the report depending on the Pricing Method and calculate the market value. If the Type of Investment is BONUS find the interest rate applicable as at the Effective Date of the report and calculate interest from the date of the last interest allocation to the Effective Date of the report. Sum the Market Values as follows: 1. For each Member check if there is a Member Values record with a Type of CONVERSION. If found read the value for Sub Type and store this as the Member’s Scheme prior to conversion. Sum the market values of the unitised portfolios, the monetary balances on the bonus portfolios and the interest calculated for the bonus portfolios for all of the Members with same previous Scheme. 2. Sum the market values of the unitised portfolios, the monetary balances on the bonus portfolios and the interest calculated for the bonus portfolios for all of the Members for which a CONVERSION record is not found |

|

20 |

Total Credit Account balances for deferred members previous period |

Determine the market value of the DEFERRED and DEF ANNUITANT Members’ Credit Account investments. Retrieve the Monetary balance on the Member’s INVESTMEMB accounts and the unit balance on the Member’s INVSTMEMUNIT accounts for the Income Types for which the value for Member Investment Choice is N as at the Effective Date of the report minus 6 months. If the Type of Investment is UNITISED find the unit price applicable as at the Effective Date of the report minus 6 months depending on the Pricing Method and calculate the market value. If the Type of Investment is BONUS find the interest rate applicable as at the Effective Date of the report minus 6 months and calculate interest from the date of the last interest allocation to the Effective Date of the report minus 6 months. Sum the market values of the unitised portfolios, the monetary balances on the bonus portfolios and the interest calculated for the bonus portfolios for all of the Members per Scheme. If no records are found display the value in the report as zero |

|

21 |

Variance |

Calculate the percentage difference between the Total Credit Account balances for deferred members in 19 and 20 above per Scheme. Calculate to 2 decimal places with normal rounding i.e. 0-4 round down and 5-9 round up. If the value for the previous period is zero display the value as zero. |

|

|

DEFERREDS |

|

|

|

Afterwork / Career Average |

|

|

22 |

Membership Totals |

Find all of the Membership records for Scheme Codes 009001 (Afterwork) and 009006 (Career Average) for which the Status as at the Effective Date of the report is DEFERRED or DEF ANNUITANT. Sum the Memberships per Scheme. |

|

23 |

Membership Totals previous period |

Find all of the Membership records for Scheme Codes 009001 (Afterwork) and 009006 (Career Average) for which the Status as at the Effective Date of the report minus 6 months is DEFERRED or DEF ANNUITANT. Sum the Memberships per Scheme. If no records are found display the value in the report as zero |

|

24 |

Variance |

Calculate the percentage difference between the Membership Total in 22 and 23 above per Scheme. Calculate to 2 decimal places with normal rounding i.e. 0-4 round down and 5-9 round up. If the value for the previous period is zero display the value as zero. |

|

|

1964 Barclays Deferreds Only |

|

|

25 |

Number of deferred pensioners (excluding members with GMP only) excluding Woolwich members |

Find all of the Membership records for Scheme Code 009004 (1964) for which the Status as at the Effective Date of the report is DEFERRED or DEF ANNUITANT and for which the Benefit Membership Group is not a Woolwich Membership Group (see table in 2.2.1.2 Woolwich Deferred Benefit Membership Groups below). Sum the number of Memberships excluding the GMP only Members (see below) per Scheme. GMP Only Members: Read the Benefit Package for the Benefit Membership Group to which the Membership is associated and for the Benefit Event for which the Event Sub-Category is NORMAL RETIRAL. Determine the pension that the member would receive as at the Effective Date of the Report. If the Member’s age is greater than Normal Retirement Age (NRA) read the Benefit Package for the Benefit Membership Group for which the Event Sub-Category is LATE RETIRAL. If a pension is only calculated with a Benefit Type of PO88 or PR88 exclude these members from the count of deferred pensioners and include in the total number of deferred pensioners with GMP only (see 28 below). |

|

26 |

Number of deferred pensioners (excluding members with GMP only) excluding Woolwich members previous period |

Find all of the Membership records for Scheme Code 009004 (1964) for which the Status as at the Effective Date of the report minus 6 months is DEFERRED or DEF ANNUITANT and for which the Benefit Membership Group is not a Woolwich Membership Group (see table in 2.2.1.2 Woolwich Deferred Benefit Membership Groups below. Sum the number of Memberships excluding the GMP only Members (see above) per Scheme. If no records are found display the value in the report as zero |

|

27 |

Variance |

Calculate the percentage difference between the values in 25 and 26 above per Scheme. Calculate to 2 decimal places with normal rounding i.e. 0-4 round down and 5-9 round up. If the value for the previous period is zero display the value as zero. |

|

28 |

Number of deferred pensioners with GMP only excluding Woolwich members |

Total of Members for which only a pension with a Benefit Type of PR88 or PO88 will be paid on retirement (see above) and for which the Benefit Membership Group is not a Woolwich Membership Group (see table in 2.2.1.2 Woolwich Deferred Benefit Membership Groups below, per Scheme. |

|

29 |

Number of deferred pensioners with GMP only previous period |

Total of Members as at the Effective Date of the report minus 6 months for which only a pension with a Benefit Type of PR88 or PO88 will be paid on retirement (see above) and for which the Benefit Membership Group is not a Woolwich Membership Group (see table in 2.2.1.2 Woolwich Deferred Benefit Membership Groups below, per Scheme. If no records are found display the value in the report as zero |

|

30 |

Variance |

Percentage difference between the number of deferred pensioners with GMP only in 28 and 29 above. Calculate to 2 decimal places with normal rounding i.e. 0-4 round down and 5-9 round up. If the value for the previous period is zero display the value as zero. |

|

31 |

Current value of deferred pensions including GMP (excluding members with GMP only) |

Find all of the Membership records for Scheme Code 009004 (1964) for which the Status as at the Effective Date of the report is DEFERRED or DEF ANNUITANT. Read the Benefit Package for the Benefit Membership Group to which the Membership is associated and for the Benefit Event for which the Event Sub-Category is NORMAL RETIRAL. Determine the pension that the member will receive based on service to the Effective Date of the report. If the Member’s age is greater than the NRA read the Benefit Package with an Event Sub-Category of LATE RETIRAL. If a pension is only calculated with a Benefit Type of PO88 or PR88 exclude the value of these pensions and include them in the values for Current value of deferred GMP only pensions (Pre 88 + Post 88) (see 34 and 37 below), Current value of deferred Pre 88 GMP pensions (members with GMP only) (see 34 below) or Current value of deferred Post 88 GMP pensions (members with GMP only) (see 37 below) Sum the values per Scheme. |

|

32 |

Current value of deferred pensions including GMP (excluding members with GMP only) previous period |

Find all of the Membership records Scheme Code 009004 (1964) for which the Status as at the Effective Date of the report minus 6 months is DEFERRED or DEF ANNUITANT. Read the Benefit Package for the Benefit Membership Group to which the Membership is associated and for the Benefit Event for which the Event Category is NORMAL RETIRAL. Determine the pension that the member will receive based on service to the Effective Date of the report minus 6 months. If the Member’s age is greater than the NRA read the Benefit Package with an Event Sub-Category of LATE RETIRAL. If a pension is only calculated with a Benefit Type of PO88 or PR88 exclude the value of these pensions. If no records are found display the value in the report as zero |

|

33 |

Variance |

Calculate the percentage difference between the Current value of deferred pensions including GMP (excluding members with GMP only) in 31 and 32 above per Scheme. Calculate to 2 decimal places with normal rounding i.e. 0-4 round down and 5-9 round up. If the value for the previous period is zero display the value as zero. |

|

34 |

Current value of deferred Pre 88 GMP pensions (excluding members with GMP only) |

Find all of the Membership records for Scheme Code 009004 (1964) for which the Status as at the Effective Date of the report is DEFERRED or DEF ANNUITANT. Read the Benefit Package for the Benefit Membership Group to which the Membership is associated and for the Benefit Event for which the Event Category is NORMAL RETIRAL. Determine the pension that the member will receive based on service to the Effective Date of the report. If the Member’s age is greater than the NRA read the Benefit Package with an Event Sub-Category of LATE RETIRAL. If a pension is only calculated with a Benefit Type of PO88 or PR88 exclude the value of these pensions Sum the values for the pensions with a Benefit Type of PR88 per Scheme. |

|

35 |

Current value of deferred Pre 88 GMP pensions (excluding members with GMP only) previous period |

Find all of the Membership records for Scheme Code 009004 (1964) for which the Status as at the Effective Date of the report minus 6 months is DEFERRED or DEF ANNUITANT. Read the Benefit Package for the Benefit Membership Group to which the Membership is associated and for the Benefit Event for which the Event Category is NORMAL RETIRAL. Determine the pension that the member will receive based on service to the Effective Date of the report minus 6 months. If the Member’s age is greater than the NRA read the Benefit Package with an Event Sub-Category of LATE RETIRAL. If a pension is only calculated with a Benefit Type of PO88 or PR88 exclude the value of these pensions Sum the values for the pensions with a Benefit Type of PR88 per Scheme. If no records are found display the value in the report as zero |

|

36

|

Variance |

Calculate the percentage difference between the Current value of deferred Pre 88 GMP pensions (excluding members with GMP only) in 34 and 35 above. Calculate to 2 decimal places with normal rounding i.e. 0-4 round down and 5-9 round up. If the value for the previous period is zero display the value as zero. |

|

37 |

Current value of deferred Post 88 GMP pensions (excluding members with GMP only) |

Find all of the Membership records for Scheme Code 009004 (1964) for which the Status as at the Effective Date of the report is DEFERRED or DEF ANNUITANT. Read the Benefit Package for the Benefit Membership Group to which the Membership is associated and for the Benefit Event for which the Event Category is NORMAL RETIRAL. Determine the pension that the member will receive based on service to the Effective Date of the report. If the Member’s age is greater than the NRA read the Benefit Package with an Event Sub-Category of LATE RETIRAL. If a pension is only calculated with a Benefit Type of PO88 or PR88 exclude the value of these pensions Sum the values for the pensions with a Benefit Type of PO88 per Scheme. |

|

38 |

Current value of deferred Post 88 GMP pensions (excluding members with GMP only) previous period |

Find all of the Membership records Scheme Code 009004 (1964) for which the Status as at the Effective Date of the report minus 6 months is DEFERRED or DEF ANNUITANT. Read the Benefit Package for the Benefit Membership Group to which the Membership is associated and for the Benefit Event for which the Event Category is NORMAL RETIRAL. Determine the pension that the member will receive based on service to the Effective Date of the report minus 6 months. If the Member’s age is greater than the NRA read the Benefit Package with an Event Sub-Category of LATE RETIRAL. If a pension is only calculated with a Benefit Type of PO88 or PR88 exclude the value of these pensions Sum the values for the pensions with a Benefit Type of PO88 per Scheme. If no records are found display the value in the report as zero |

|

39 |

Variance |

Calculate the percentage difference between the Current value of deferred Post 88 GMP pensions (excluding members with GMP only) in 37 and 38 above. Calculate to 2 decimal places with normal rounding i.e. 0-4 round down and 5-9 round up. If the value for the previous period is zero display the value as zero. |

|

40 |

Current value of deferred SPD |

Find all of the Membership records for Scheme Code 009004 (1964) for which the Status as at the Effective Date of the report is DEFERRED or DEF ANNUITANT. Read the Benefit Package for the Benefit Membership Group to which the Membership is associated and for the Benefit Event for which the Event Category is NORMAL RETIRAL. Determine the pension that the member will receive based on service to the Effective Date of the report. If the Member’s age is greater than the NRA read the Benefit Package with an Event Sub-Category of LATE RETIRAL. If a pension is only calculated with a Benefit Type of PO88 or PR88 exclude the value of these pensions Sum the values for the pensions with a Benefit Type of SPD per Scheme. |

|

41 |

Current value of deferred SPD previous period |

Find all of the Membership records for which the Status as at the Effective Date of the report minus 6 months is DEFERRED or DEF ANNUITANT. Read the Benefit Package for the Benefit Membership Group to which the Membership is associated and for the Benefit Event for which the Event Category is NORMAL RETIRAL. Determine the pension that the member will receive based on service to the Effective Date of the report minus 6 months. If the Member’s age is greater than the NRA read the Benefit Package with an Event Sub-Category of LATE RETIRAL. If a pension is only calculated with a Benefit Type of PO88 or PR88 exclude the value of these pensions Sum the values for the pensions with a Benefit Type of SPD per Scheme. If no records are found display the value in the report as zero |

|

42 |

Variance |

Calculate the percentage difference between the Current value of deferred SPD in 40 and 41 above. Calculate to 2 decimal places with normal rounding i.e. 0-4 round down and 5-9 round up. If the value for the previous period is zero display the value as zero. |

|

|

1964 Barclays GMP Only |

|

|

43 |

Current value of deferred GMP only pensions (Pre 88 + Post 88) |

Find all of the Membership records for Scheme Code 009004 (1964) for which the Status as at the Effective Date of the report is DEFERRED or DEF ANNUITANT. Read the Benefit Package for the Benefit Membership Group to which the Membership is associated and for the Benefit Event for which the Event Category is NORMAL RETIRAL. Determine the pension that the member will receive based on service to the Effective Date of the report. If the Member’s age is greater than the NRA read the Benefit Package with an Event Sub-Category of LATE RETIRAL. If a pension is only calculated with a Benefit Type of PO88 or PR88 include the value of these pensions. Sum the values for the pensions with a Benefit Type of PR88 and PO88 per Scheme. |

|

44 |

Current value of deferred GMP only pensions (Pre 88 + Post 88)previous period |

Find all of the Membership records for Scheme Code 009004 (1964) for which the Status as at the Effective Date of the report minus 6 months is DEFERRED or DEF ANNUITANT. Read the Benefit Package for the Benefit Membership Group to which the Membership is associated and for the Benefit Event for which the Event Category is NORMAL RETIRAL. Determine the pension that the member will receive based on service to the Effective Date of the report minus 6 months. If the Member’s age is greater than the NRA read the Benefit Package with an Event Sub-Category of LATE RETIRAL. If a pension is only calculated with a Benefit Type of PO88 or PR88 include the value of these pensions. Sum the values for the pensions with a Benefit Type of PR88 and PO88 per Scheme. If no records are found display the value in the report as zero |

|

45 |

Variance |

Calculate the percentage difference Current value of deferred GMP only pensions (Pre 88 + Post 88) in 43 and 44 above per Scheme. Calculate to 2 decimal places with normal rounding i.e. 0-4 round down and 5-9 round up. If the value for the previous period is zero display the value as zero. |

|

46 |

Current value of deferred Pre 88 GMP pensions (members with GMP only) |

Find all of the Membership records for Scheme Code 009004 (1964) for which the Status as at the Effective Date of the report is DEFERRED or DEF ANNUITANT. Read the Benefit Package for the Benefit Membership Group to which the Membership is associated and for the Benefit Event for which the Event Category is NORMAL RETIRAL. Determine the pension that the member will receive based on service to the Effective Date of the report. If the Member’s age is greater than the NRA read the Benefit Package with an Event Sub-Category of LATE RETIRAL. If a pension is only calculated with a Benefit Type of PO88 or PR88 include the value of these pensions. Sum the values for the pensions with a Benefit Type of PR88 per Scheme. |

|

47 |

Current value of deferred Pre 88 GMP pensions (members with GMP only) previous period |

Find all of the Membership records for Scheme Code 009004 (1964) for which the Status as at the Effective Date of the report minus 6 months is DEFERRED or DEF ANNUITANT. Read the Benefit Package for the Benefit Membership Group to which the Membership is associated and for the Benefit Event for which the Event Category is NORMAL RETIRAL. Determine the pension that the member will receive based on service to the Effective Date of the report minus 6 months. If the Member’s age is greater than the NRA read the Benefit Package with an Event Sub-Category of LATE RETIRAL. If a pension is only calculated with a Benefit Type of PO88 or PR88 include the value of these pensions. Sum the values for the pensions with a Benefit Type of PR88 per Scheme. If no records are found display the value in the report as zero |

|

48 |

Variance |

Calculate the percentage difference between the Current value of deferred Pre 88 GMP pensions (members with GMP only) in 46 and 47 above per Scheme. Calculate to 2 decimal places with normal rounding i.e. 0-4 round down and 5-9 round up. If the value for the previous period is zero display the value as zero. |

|

49 |

Current value of deferred Post 88 GMP pensions (members with GMP only) |

Find all of the Membership records for Scheme Code 009004 (1964) for which the Status as at the Effective Date of the report is DEFERRED or DEF ANNUITANT. Read the Benefit Package for the Benefit Membership Group to which the Membership is associated and for the Benefit Event for which the Event Category is NORMAL RETIRAL. Determine the pension that the member will receive based on service to the Effective Date of the report. If the Member’s age is greater than the NRA read the Benefit Package with an Event Sub-Category of LATE RETIRAL. If a pension is only calculated with a Benefit Type of PO88 or PR88 include the value of these pensions. Sum the values for the pensions with a Benefit Type of PO88 per Scheme. |

|

50 |

Current value of deferred Post 88 GMP pensions (members with GMP only) previous period |

Find all of the Membership records for Scheme Code 009004 (1964) for which the Status as at the Effective Date of the report minus 6 months is DEFERRED or DEF ANNUITANT. Read the Benefit Package for the Benefit Membership Group to which the Membership is associated and for the Benefit Event for which the Event Category is NORMAL RETIRAL. Determine the pension that the member will receive based on service to the Effective Date of the report minus 6 months. If the Member’s age is greater than the NRA read the Benefit Package with an Event Sub-Category of LATE RETIRAL. If a pension is only calculated with a Benefit Type of PO88 or PR88 include the value of these pensions. Sum the values for the pensions with a Benefit Type of PO88 per Scheme. If no records are found display the value in the report as zero |

|

51 |

Variance |

Calculate the percentage difference between the Current value of deferred Post 88 GMP pensions (members with GMP only) in 49 and 50 above per Scheme. Calculate to 2 decimal places with normal rounding i.e. 0-4 round down and 5-9 round up. If the value for the previous period is zero display the value as zero. |

|

|

PENSIONERS |

|

|

52 |

Number of pensioners |

Find all of the Memberships for which there is a Membership Payment record with a Payment Type of ANNUITY effective as at the Effective Date of the report. Count all of the Membership Payment records with different Benefit Types (PR97, PO97, PR88, PO88, SPD, etc.) as one record i.e. count the number of pensioners not pension types. Sum the records per Scheme. |

|

53 |

Number of pensioners previous period |

Find all of the Memberships for which there is a Membership Payment record with a Payment Type of ANNUITY effective as at the Effective Date of the report minus 6 months. Count all of the Membership Payment records with different Benefit Types (PR97, PO97, PR88, PO88, SPD, etc.) as one record i.e. count the number of pensioners not pension types. Sum the records per Scheme. If no records are found display the value in the report as zero |

|

54 |

Variance |

Calculate the percentage difference between the Number of pensioners in 52 and 53 above per Scheme. Calculate to 2 decimal places with normal rounding i.e. 0-4 round down and 5-9 round up. If the value for the previous period is zero display the value as zero. |

|

55 |

Barclays total pensions in payment |

Find all of the Memberships for which there is a Membership Payment record with a Payment Type of ANNUITY effective as at the Effective Date of the report and for which the Member’s Annuity Membership Group is not A04 (Woolwich Flexible Retirement <75, A05 (Woolwich Pensioner <75) or A06 (Woolwich Pensioner >=75). Sum the values for Regular Payment Amount on the Membership Payment Detail records effective as at the Effective Date of the Report per Scheme. Calculate the annual pension amount by multiplying by 12. |

|

56 |

Barclays total pensions in payment previous period |

Find all of the Memberships for which there is a Membership Payment record with a Payment Type of ANNUITY effective as at the Effective Date of the report minus 6 months and for which the Member’s Annuity Membership Group is not A04 (Woolwich Flexible Retirement <75, A05 (Woolwich Pensioner <75) or A06 (Woolwich Pensioner >=75). Sum the values for Regular Payment Amount on the Membership Payment Detail records effective as at the Effective Date of the report minus 6 months per Scheme. Calculate the annual pension amount by multiplying by 12. If no records are found display the value in the report as zero |

|

57 |

Variance |

Calculate the percentage difference between the Barclays total pensions in payment in 55 and 56 above per Scheme. Calculate to 2 decimal places with normal rounding i.e. 0-4 round down and 5-9 round up. If the value for the previous period is zero display the value as zero. |

|

58 |

Woolwich total pensions in payment |

Find all of the Memberships for which there is a Membership Payment record with a Payment Type of ANNUITY effective as at the Effective Date of the report and for which the Member’s Annuity Membership Group is A04 (Woolwich Flexible Retirement <75, A05 (Woolwich Pensioner <75) or A06 (Woolwich Pensioner >=75). Sum the values for Regular Payment Amount on the Membership Payment Detail records effective as at the Effective Date of the report per Scheme. Calculate the annual pension amount by multiplying by 12. |

|

59 |

Woolwich total pensions in payment previous period |

Find all of the Memberships for which there is a Membership Payment record with a Payment Type of ANNUITY effective as at the Effective Date of the report minus 6 months and for which the Member’s Annuity Membership Group is A04 (Woolwich Flexible Retirement <75, A05 (Woolwich Pensioner <75) or A06 (Woolwich Pensioner >=75). Sum the values for Regular Payment Amount on the Membership Payment Detail records effective as at the Effective Date of the Report minus 6 months per Scheme. Calculate the annual pension amount by multiplying by 12. If no records are found display the value in the report as zero |

|

60 |

Variance |

Calculate the percentage difference between the Woolwich total pensions in payment in 58 and 59 above per Scheme. Calculate to 2 decimal places with normal rounding i.e. 0-4 round down and 5-9 round up. If the value for the previous period is zero display the value as zero. |

|

|

WIDOWS / CHILDREN |

|

|

61 |

Number of spouses and children |

Find all of the Membership Payment records for which the Relationship is SPOUSE, DEPENDANT, DISABLED DEPENDNT or FIN DEPENDANT and the Payment Type is ANNUITY effective as at the Effective Date of the report. Sum the records per Scheme. |

|

62 |

Number of spouses and children previous period |

Find all of the Membership Payment records for which the Relationship is SPOUSE, DEPENDANT, DISABLED DEPENDNT or FIN DEPENDANT and the Payment Type is ANNUITY effective as at the Effective Date of the report minus 6 months. Sum the records per Scheme. If no records are found display the value in the report as zero |

|

63 |

Variance |

Calculate the percentage difference between the Number of spouses and children in 61 and 62 above per Scheme. Calculate to 2 decimal places with normal rounding i.e. 0-4 round down and 5-9 round up. If the value for the previous period is zero display the value as zero. |

|

64 |

Barclays total spouse and children pensions |

Find all of the Memberships for which there is a Membership Payment record with a Relationship of SPOUSE, DEPENDANT, DISABLED DEPENDNT or FIN DEPENDANT with a Payment Type of ANNUITY effective as at the Effective Date of the report and for which the Member’s Annuity Membership Group is not A04 (Woolwich Flexible Retirement <75, A05 (Woolwich Pensioner <75) or A06 (Woolwich Pensioner >=75). Sum the values for Regular Payment Amount on the Membership Payment Detail records effective as at the Effective Date of the report per Scheme. Calculate the annual pension amount by multiplying by 12. |

|

65 |

Barclays total spouse and children pensions previous period |

Find all of the Memberships for which there is a Membership Payment record with a Relationship of SPOUSE, DEPENDANT, DISABLED DEPENDNT or FIN DEPENDANT with a Payment Type of ANNUITY effective as at the Effective Date of the report minus 6 months and for which the Member’s Annuity Membership Group is not A04 (Woolwich Flexible Retirement <75, A05 (Woolwich Pensioner <75) or A06 (Woolwich Pensioner >=75). Sum the values for Regular Payment Amount on the Membership Payment Detail records effective as at the Effective Date of the report minus 6 months per Scheme. Calculate the annual pension amount by multiplying by 12. If no records are found display the value in the report as zero |

|

66 |

Variance |

Calculate the percentage difference between the Barclays total spouse and children pensions in 64 and 65 above per Scheme. Calculate to 2 decimal places with normal rounding i.e. 0-4 round down and 5-9 round up. If the value for the previous period is zero display the value as zero. |

|

67 |

Woolwich total spouse and children pensions |

Find all of the Memberships for which there is a Membership Payment record with a Relationship of SPOUSE, DEPENDANT, DISABLED DEPENDNT or FIN DEPENDANT with a Payment Type of ANNUITY effective as at the Effective Date of the report and for which the Member’s Annuity Membership Group is A04 (Woolwich Flexible Retirement <75, A05 (Woolwich Pensioner <75) or A06 (Woolwich Pensioner >=75). Sum the values for Regular Payment Amount on the Membership Payment Detail records effective as at the Effective Date of the report per Scheme. Calculate the annual pension amount by multiplying by 12. |

|

68 |

Woolwich total spouse and children pensions previous period |

Find all of the Memberships for which there is a Membership Payment record with a Relationship of SPOUSE, DEPENDANT, DISABLED DEPENDNT or FIN DEPENDANT with a Payment Type of ANNUITY effective as at the Effective Date of the report minus 6 months and for which the Member’s Annuity Membership Group is A04 (Woolwich Flexible Retirement <75, A05 (Woolwich Pensioner <75) or A06 (Woolwich Pensioner >=75). Sum the values for Regular Payment Amount on the Membership Payment Detail records effective as at the Effective Date of the report minus 6 months per Scheme. Calculate the annual pension amount by multiplying by 12. If no records are found display the value in the report as zero |

|

69 |

Variance |

Calculate the percentage difference between the Woolwich total spouse and children pensions in 67 and 68 above per Scheme. Calculate to 2 decimal places with normal rounding i.e. 0-4 round down and 5-9 round up. If the value for the previous period is zero display the value as zero. |

Opt Out Life Assurance Only Membership Groups

|

BA07 |

Life Assurance Only – Under 25 |

|

BA11 |

Opted Out with Deferred & Life Assurance - NRA 60 - Early from 50 |

|

BA12 |

Opted Out with Deferred & Life Assurance - NRA 60 - Early from 55 |

|

BA13 |

Opted Out with Deferred & Life Assurance - NRA 65 |

|

BA14 |

Opted Out with Deferred & Life Assurance - NRA 70 |

|

BA15 |

Opted Out Transitional with Deferred & Life Assurance - NRA 60 - Early from 50 |

|

BA16 |

Opted Out Transitional with Deferred & Life Assurance - NRA 60 - Early from 55 |

|

BA17 |

Opted Out Transitional with Deferred & Life Assurance - NRA 65 |

|

BA18 |

Opted Out Transitional with Deferred & Life Assurance - NRA 70 |

|

BA19 |

Life Assurance Only |

|

BA20 |

Life Assurance Only Flexible Retirement |

Woolwich Deferred Benefit Membership Groups

|

BD27 |

Deferred Woolwich member joined pre 1/10/1983 |

|

BD35 |

Woolwich post 89 joiners Deferred 1/10/74-16/05/90 |

|

BD36 |

Woolwich post 89 joiners Deferred 17/05/90-19/07/95 |

|

BD37 |

Woolwich post 89 joiners Deferred 20/07/95-30/06/01 |

|

BD38 |

Woolwich joiners 87-89 Deferred 1/10/74-16/05/90 |

|

BD39 |

Woolwich joiners 87-89 Deferred 17/05/90-19/07/95 |

|

BD40 |

Woolwich joiners 87-89 Deferred 20/07/95-30/06/01 |

|

BD41 |

Woolwich pre 87 joiners Deferred 1/10/74-16/05/90 |

|

BD42 |

Woolwich pre 87 joiners Deferred 17/05/90-19/07/95 |

|

BD43 |

Woolwich pre 87 joiners Deferred 20/07/95-30/06/01 |

|

BD44 |

Woolwich post 89 joiners Deferred 30/06/01 64 Deferred 01/07/01-13/02/03 |

|

BD45 |

Woolwich joiners Deferred 30/06/01 64 Deferred 01/07/01-13/02/03 |

|

BD46 |

Woolwich pre 87 joiners Deferred 30/06/01 64 Deferred 01/07/01-13/02/03 |

|

BD47 |

Woolwich Non-Transferring post 89 joiners Deferred 30/06/01 64 Deferred 14/02/03-30/11/09 |

|

BD48 |

Woolwich Non-Transferring post 89 joiners Deferred 30/06/01 64 Deferred on 30/11/09 |

|

BD49 |

Woolwich Non-Transferring joiners 87-89 Deferred 30/06/01 64 Deferred 14/02/03-30/11/09 |

|

BD50 |

Woolwich Non-Transferring joiners 87-89 Deferred 30/06/01 64 Deferred 30/11/09 |

|

BD51 |

Woolwich Non-Transferring pre 87 joiners Deferred 30/06/01 64 Deferred 14/02/03-30/11/09 |

|

BD52 |

Woolwich Non-Transferring pre 87 joiners Deferred 30/06/01 64 Deferred 30/11/09 |

|

BD53 |

Woolwich Transferring post 89 joiners Deferred 14/02/03-30/11/09 |

|

BD54 |

Woolwich Transferring 87-89 joiners Deferred 14/02/03-30/11/09 |

|

BD55 |

Woolwich Transferring pre 87 joiners Deferred 14/02/03-30/11/09 |

|

BD56 |

Woolwich Transferring post 89 joiners Deferred 30/11/09 |

|

BD57 |

Woolwich Transferring 87-89 joiners Deferred 30/11/09 |

|

BD58 |

Woolwich Transferring pre 87 joiners Deferred 30/11/09 |

|

BD65 |

T&C Woolwich Deferred 01/10/92-19/07/95 |

|

BD66 |

T&C Woolwich Deferred 20/07/95-30/06/01 |

|

BD67 |

T&C Woolwich 64 Deferred 01/07/01-13/02/03 |

|

BD68 |

T&C Woolwich Non-Transferring 64 Deferred 14/02/03-30/11/09 |

|

BD69 |

T&C Woolwich Non-Transferring 64 Deferred on 30/11/09 |

|

BD70 |

T&C Woolwich Transferring 64 Deferred 14/02/03-30/11/09 |

|

BD71 |

T&C Woolwich Transferring 64 Deferred on 30/11/09 |

|

BD79 |

Gateway Woolwich Deferred 31/10/88-16/05/90 |

|

BD80 |

Gateway Woolwich Deferred 16/05/90-19/07/95 |

|

BD81 |

Gateway Woolwich Deferred 20/07/95-30/06/01 |

|

BD82 |

Gateway Woolwich 64 Deferred 01/07/01-13/02/03 |

|

BD83 |

Gateway Woolwich Non-Transferring 64 Deferred 14/02/03-30/11/09 |

|

BD84 |

Gateway Woolwich Non-Transferring 64 Deferred on 30/11/09 |

|

BD85 |

Gateway Woolwich Transferring 64 Deferred 14/02/03-30/11/09 |

|

BD86 |

Gateway Woolwich Transferring 64 Deferred on 30/11/09 |

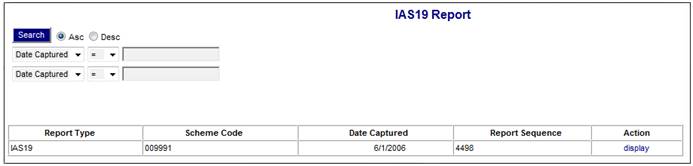

Click View below IAS19 Report. The IAS19 Report selection screen will be displayed.

The following columns are displayed:

- Report Type

- Scheme Code

- Date Captured

- Report Sequence

- Action

To select a report, click on the hyperlinked display in the Action column alongside the appropriate selection in the Report Type column.

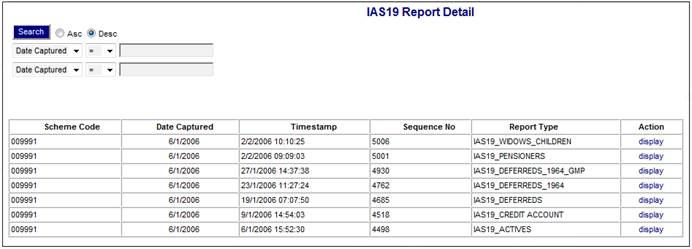

The IAS19 Report Detail screen will be displayed.

The following columns are displayed:

- Scheme Code

- Date Captured

- Timestamp

- Sequence Number

- Report Type

- Action

To select a report, click on the hyperlinked display in the Action column.

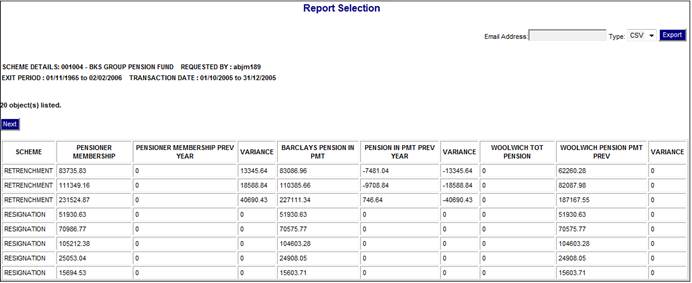

The Report Selection screen will be displayed. This screen displays the details of the report.

Example

The following columns are displayed:

- Scheme

- Pensioner Membership

- Pensioner Membership Previous Year

- Variance

- Barclays Pension in payment

- Pension in payment previous year

- Variance

- Woolwich Total Pension

- Woolwich Pension Payment Previous

- Variance

The following information is extracted and displayed in the report, depending on the scheme:

Actives

Split per grouping and previous Scheme in the case of group 1 (Refer to Report Breakdown per section below).

|

Active Membership Current Period |

Active Membership Previous Period |

Variance |

Total FTE Salary Roll Current Period |

Total FTE Salary Roll Previous Period |

Variance |

Total Actual Salary Roll Current Period |

Total Actual Salary Roll Previous Period |

Variance |

|

1.3 |

2.3 |

3.3 |

4.3 |

5.3 |

6.3 |

7.3 |

8.3 |

9.3 |

|

1.4 |

2.4 |

3.4 |

4.4 |

5.4 |

6.4 |

7.4 |

8.4 |

9.4 |

|

Sub-total |

Sub-total |

Sub-total |

Sub-total |

Sub-total |

Sub-total |

Sub-total |

Sub-total |

Sub-total |

|

1.2 |

2.2 |

3.2 |

4.2 |

5.2 |

6.2 |

7.2 |

8.2 |

9.2 |

|

1.5 |

2.5 |

3.5 |

4.5 |

5.5 |

6.5 |

7.5 |

8.5 |

9.5 |

|

Sub-total |

Sub-total |

Sub-total |

Sub-total |

Sub-total |

Sub-total |

Sub-total |

Sub-total |

Sub-total |

|

1.1 |

2.1 |

3.1 |

4.1 |

5.1 |

6.1 |

7.1 |

8.1 |

9.1 |

|

1.6 |

2.6 |

3.6 |

4.6 |

5.6 |

6.6 |

7.6 |

8.6 |

9.6 |

|

Total |

Total |

Total |

Total |

Total |

Total |

Total |

Total |

Total |

Pensioners

Split per Scheme (Refer to Report Breakdown per section below).

|

Pensioner Membership Current Period |

Pensioner Membership Previous Period |

Variance |

Barclays Total Pensions in Payment Current Period |

Barclays Total Pensions in Payment Previous Period |

Variance |

Woolwich Total Pensions in Payment Current Period |

Woolwich Total Pensions in Payment Previous Period |

Variance |

|

52 |

53 |

54 |

55 |

56 |

57 |

58 |

59 |

60 |

|

Total |

Total |

Total |

Total |

Total |

Total |

Total |

Total |

Total |

Widows / Children

Split per Scheme (Refer to Report Breakdown per section below).

|

Pensioner Membership Current Period |

Pensioner Membership Previous Period |

Variance |

Barclays Total Pensions in Payment Current Period |

Barclays Total Pensions in Payment Previous Period |

Variance |

Woolwich Total Pensions in Payment Current Period |

Woolwich Total Pensions in Payment Previous Period |

Variance |

|

61 |

62 |

63 |

64 |

65 |

66 |

67 |

68 |

69 |

|

Total |

Total |

Total |

Total |

Total |

Total |

Total |

Total |

Total |

Credit Account

Split per grouping and per previous Scheme (Refer to Report Breakdown per section below).

|

Membership Totals Current Period |

Membership Totals Previous Period |

Variance |

Value of Credit Account Current Period |

Value of Credit Account Previous Period |

Variance |

|

|

10.2 |

11.2 |

12.2 |

13.2 |

14.2 |

15.2 |

Actives – per previous fund |

|

10.3 |

11.3 |

12.3 |

13.3 |

14.3 |

15.3 |

BLA Opt Outs |

|

10.1 |

11.1 |

12.1 |

13.1 |

14.1 |

15.1 |

BLA Opt Outs previous fund |

|

10.4 |

11.4 |

12.4 |

13.4 |

14.4 |

15.4 |

Actives – non legacy |

|

16.2 |

17.2 |

18.2 |

19.2 |

20.2 |

21.2 |

Deferred’s |

|

16.1 |

17.1 |

18.1 |

19.1 |

20.1 |

21.1 |

Deferred’s – per previous fund |

Deferreds

Split per Scheme (Refer to Report Breakdown per section below).

Afterwork / Career Average

|

Member-ship Totals Current Period |

Member-ship Totals Previous Period |

Var |

|

|

|

|

|

|

|

22 |

23 |

24 |

|

|

|

|

|

|

|

Total |

Total |

Total |

Total |

Total |

Total |

Total |

Total |

Total |

1964 (Barclays Deferred Only)

|

Deferred Member-ship Current Period |

Deferred Member-ship Prev Period |

Var |

Current Deferred Value inc GMP Current Period |

Current Deferred Value inc GMP Previous Period |

Var |

Current Pre 88 GMP Value Current Period |

Current Pre 88 GMP Value Prev Period |

Var |

Current Post 88 GMP Value Current Period |

Current Post 88 GMP Value Prev Period |

Var |

Current SPD Value Current Period |

Current SPD Value Prev Period |

Var |

|

25 |

26 |

27 |

31 |

32 |

33 |

34 |

35 |

36 |

37 |

38 |

39 |

40 |

41 |

42 |

|

Total |

Total |

Total |

Total |

Total |

Total |

Total |

Total |

Total |

Total |

Total |

Total |

Total |

Total |

Total |

1964 (Barclays GMP Only)

|

GMP Only Member-ship Current Period |

GMP Only Member-ship Prev Period |

Var |

Current GMP Value Pre + Post 88 GMP Current Period |

Current GMP Value Pre + Post 88 GMP Previous Period |

Var |

Current Pre 88 GMP Value Current Period |

Current Pre 88 GMP Value Prev Period |

Var |

Current Post 88 GMP Value Current Period |

Current Post 88 GMP Value Prev Period |

Var |

|

28 |

29 |

30 |

43 |

44 |

45 |

46 |

47 |

48 |

49 |

50 |

51 |

|

Total |

Total |

Total |

Total |

Total |

Total |

Total |

Total |

Total |

Total |

Total |

Total |

The following table indicates the breakdown of the rows within each section of the report and the value to be displayed in the Scheme column.

Note:

Values derived from the system e.g. Scheme Name, Previous Scheme or Membership Group or are typed in normal text and text values to be included in the Scheme column is typed in italics e.g.- non legacy.

Actives

|

Scheme |

Values |

|

Scheme Name / Contribution Membership Group |

1.3 – 9.3 |

|

Scheme Name / Contribution Membership Group |

1.4 – 9.4 |

|

Total |

Total |

|

Scheme Name / BLA (Opt Outs) |

1.2 – 9.2 |

|

Scheme Name / BLA |

1.5 – 9.5 |

|

Total |

Total |

|

Previous Scheme |

1.1 – 9.1 |

|

Scheme Name / BLA (Flexible Retirement) |

1.6 – 9.6 |

|

Total |

Total |

Pensioners

|

Scheme |

Values |

|

Scheme Name |

52 - 60 |

|

Total |

Total |

Widows / Children

|

Scheme |

Values |

|

Scheme Name |

61 - 69 |

|

Total |

Total |

Credit Account

|

Scheme |

Values |

|

Scheme Name / Actives |

10.4 – 15.4 |

|

Scheme Name / Actives / Previous Scheme |

10.2 – 15.2 |

|

Scheme Name / BLA (Opt Outs) / Previous Scheme |

10.1 – 15.1 |

|

Scheme Name / BLA (Opt Outs) |

10.3 – 15.2 |

|

Scheme Name / Deferreds |

16.2 – 21.2 |

|

Scheme Name / Deferreds / Previous Scheme |

16.1 – 21.1 |

|

Total |

Total |

Deferreds

Afterwork / Career Average

|

Scheme |

Values |

|

Scheme Name / (inc Def Protected Rights Only) |

22 - 24 |

|

Total |

Total |

1964 (Barclays Deferred Only)

|

Scheme |

Values |

|

Scheme Name / (Barclays Deferreds Only, excludes Woolwich) |

25 – 27 and 31 - 42 |

|

Total |

Total |

1964 (Barclays GMP Only)

|

Scheme |

Values |

|

Scheme Name / (Barclays GMP only, excludes Woolwich |

28 – 30 and 43 - 51 |

|

Total |

Total |